Overview

In Volume Oscillator Confirms Price Movement we looked at the measurement of volume by way of an oscillator using two moving averages. In this article we look at the Volume Rate of Change (V-ROC), and we'll focus on the importance of price movements and volume in the study of market trends.

In the last decade, we've seen triple-digit swings on the Dow Jones Industrial Index to both the upside and the downside. A newcomer to the science of technical analysis may not have realized that some of these moves lacked conviction, as volume didn't always support the price movement. Chartists are not the least bit interested in a 5 to 10% move in a stock price if the volume moving the price is a fraction of the normal daily volume for that particular issue. On the other hand, since the Nasdaq market volume reaches or surpasses two billion shares per day, significant price action will trigger the interest of analysts. If price movements are significantly less than 5 to 10%, you might as well go golfing.

Description

Volume Rate of Change (V-ROC) is the indicator that shows whether or not a volume trend is developing in either an up or down direction. You may be familiar with price rate of change (discussed here), which shows an investor the rate of change measured by the issue's closing price. To calculate this, you need to divide the volume change over the last n-periods (days, weeks or months) by the volume n-periods ago. The answer is a percentage change of the volume over the last n-periods. Now, what does this mean? If the volume today is higher than n-days (or weeks or months) ago, the rate of change will be a plus number. If volume is lower, the (V-ROC) will be minus number. This allows us to look at the speed at which the volume is changing.

To find out more about this indicator and it`s trading signals click here.

Settings in the chart

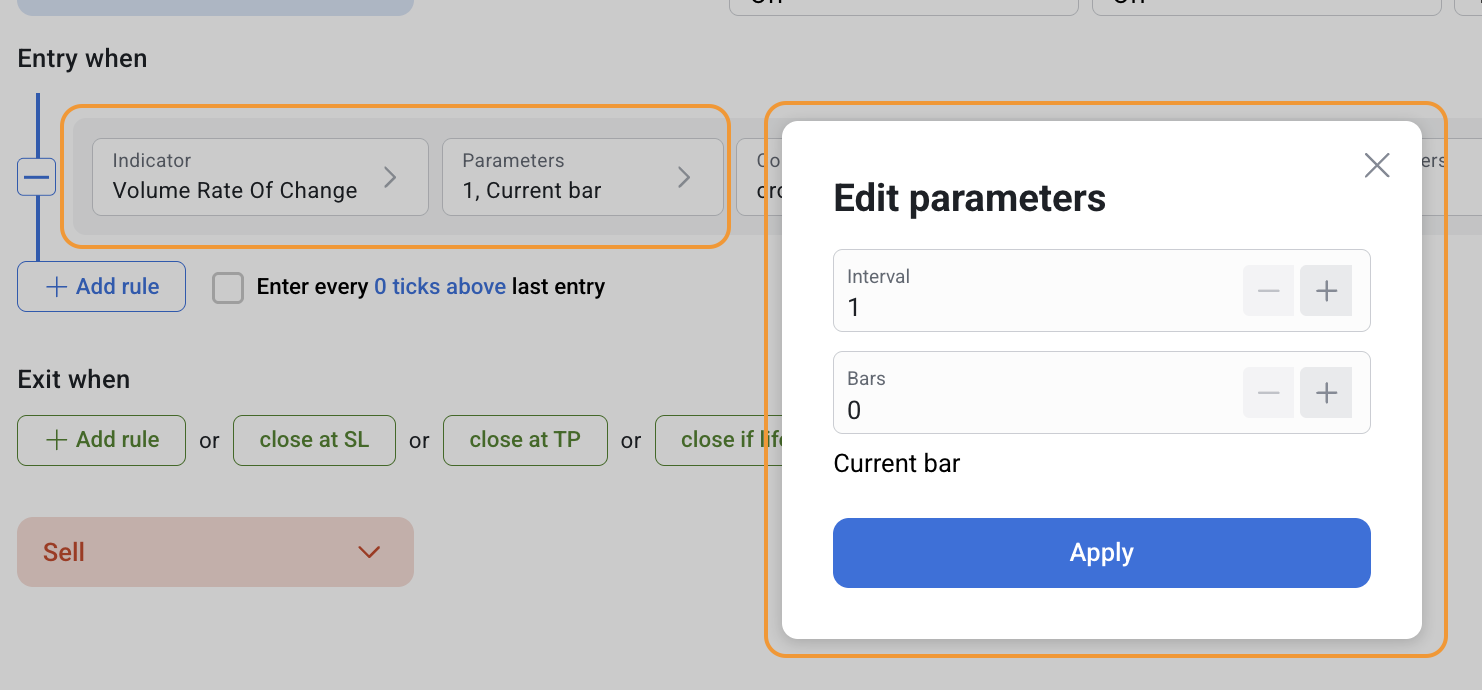

Settings in Strategies

Volume Rate Of Change can be used both separately and together with other indicators in the RoboBuilder.